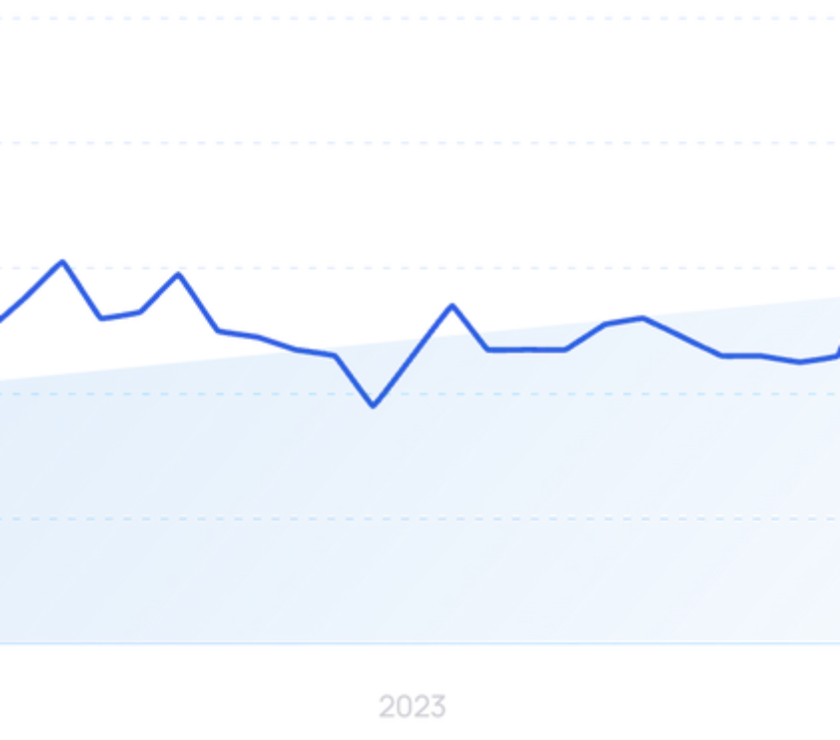

Analysis reveals declining confirmed updates from 10 in 2021 to 4 in 2025 while perceived volatility reaches record-breaking levels across algorithmic earthquakes.

On December 29, 2025, SEO consultant Gagan Ghotra published detailed visualizations documenting five years of Google search ranking volatility. The analysis reveals a dramatic transformation from predictable, episodic algorithm updates to continuous, high-intensity ranking fluctuations that redefined search engine optimization practices between 2021 and 2025.

Ghotra’s data shows confirmed algorithm updates decreased from 10 in both 2021 and 2022 to just 4 in 2025. Yet general volatility levels increased substantially during the same period. The 2021 environment maintained elevated volatility levels compared to pre-2020 conditions. By 2024, volatility reached record-breaking intensity before 2025 introduced what Ghotra characterized as “fever pitch” conditions with fewer official confirmations.

Your go-to source for digital marketing news.

No spam. Unsubscribe anytime.

The documentation traces specific turning points across each calendar year. January 2021 began with unconfirmed post-core tremors showing traffic drops between 30-40%. These early fluctuations represented what later analysis identified as echo effects from previous algorithm adjustments. February brought sustained low volatility until late March when the massive weekend update struck. The late February timing corresponds with what tracking tools labeled “Total Nightmares” update, though Google never confirmed this adjustment officially.

April 8-22, 2021 marked the Product Reviews Update rollout. This algorithmic change targeted low-quality affiliate content while rewarding in-depth original research. The implementation affected primarily e-commerce and review sectors. June brought back-to-back core updates across June 2-12 and July 1-12, creating prolonged instability that kept search professionals analyzing ranking movements for six consecutive weeks.

The July 26-August 24 period saw the Link Spam Update implementation. This adjustment nullified unnatural affiliate and sponsored links that had previously influenced rankings. November 17-30 delivered another core update coinciding with holiday shopping, prioritizing proximity and physical location signals for local businesses. The controversial Black Friday timing drew criticism from publishers experiencing traffic drops during their most profitable period.

December 1-21 brought the December Product Reviews Update. The year-end cascade combined releases across core updates, spam updates, and local search updates. Multiple algorithmic systems received adjustments simultaneously, creating what site owners described as diagnostic impossibility when attempting to determine specific causes for ranking changes.

Follow PPC Land on your socials: LinkedIn, Google, Google News, X, Mastodon, Bluesky, Reddit, Threads or via RSS

The year 2022 brought different challenges. March 23-April 6 introduced the Product Reviews Update III with refined quality criteria that continued focus on expert perspectives and in-depth analysis. This represented the third iteration of review-focused adjustments within twelve months. The May 25-June 9 Broad Core Update became the first in six months, generating profound impact across multiple niches.

Product Reviews Update launched July 27-August 11, emphasizing original insights and product testing documentation. The August 26-September 8 period saw the first Helpful Content Update launch. Google introduced a new sitewide signal designed to identify and suppress content created primarily for search engines rather than humans. This represented a significant philosophical shift in how Google evaluated content purpose and user value.

The September 13-26 period brought the September Broad Core Update launch immediately after Helpful Content Update completion. This timing created complex volatile environments as multiple ranking systems adjusted simultaneously. Publishers reported diagnosis became impossible when two major updates overlapped their implementation windows. October saw a month of “hectic” volatility with global rollout and enveloped updates that ran without clear boundaries.

December 5-14 featured the Helpful Content Update alongside a simultaneous Link Spam Update rollout. SpamBrain AI deployment occurred for the first time, introducing machine learning at scale for spam detection. Both updates together targeted sitewid violations and specific schemes, making impact assessment difficult for affected publishers.

Buy ads on PPC Land. PPC Land has standard and native ad formats via major DSPs and ad platforms like Google Ads. Via an auction CPM, you can reach industry professionals.

The patterns shifted further in 2023. March 15-28 marked the first of four major core refinements characterized by E-E-A-T framework integration and helpfulness criteria being built directly into core ranking systems. August 22-September 7 brought another August Core Update with broad global impact focused on quality refinements across diverse content categories.

September 14-28 introduced the Helpful Content Update that would later become a watershed moment for thousands of publishers. This implementation created devastating long-term traffic loss affecting numerous independent sites. The update became a benchmark for HCU victims tracking their traffic decline trajectories. October 5-19 delivered another Core Update compounding volatility immediately after September’s HCU rollout. The back-to-back timing made diagnosis extremely difficult.

November 2-28 brought the November Core Update representing the most intense core update in months according to tracking tool measurements. The extended implementation period created uncertainty lasting nearly the entire month.

By 2024, Google had entered what Ghotra termed “The Era of Perpetual Motion.” January through February saw constant phantom shifts characterized by core-level volatility without official confirmations. Tracking tools detected movements resembling major updates, but Google remained silent about specific system changes. March 5-April 19 delivered the 45-Day Overhaul combining massive Core and Spam Updates. The Helpful Content Update integrated directly into core ranking systems during this period, creating a monolithic 45-day rollout.

Some sites experienced traffic collapse exceeding 80% during implementation. The consolidation represented Google’s most aggressive algorithmic restructuring in years. May brought confirmation of “constant updates” as an official paradigm. Google acknowledged it continuously makes unannounced smaller core updates between major confirmed releases. This admission validated what site owners had observed for months regarding unexplained ranking volatility.

June witnessed a spam update targeting new patterns of link manipulation and low-quality content schemes. August 15-September 3 brought an August Core Update positioned as addressing feedback criticism regarding unfair penalization of independent publishers. The implementation produced mixed results with some recoveries but many additional declines.

The November 11-December 5 period featured a Thanksgiving Marathon representing a 24-day core update window. The extended implementation occurred during Attach Friday and peak holiday shopping traffic. December 12-18 witnessed what Ghotra labeled “Fast and Furious” as the fastest core update on record requiring only six days. A spam update “burned through Christmas” following immediately after core update completion.

The data for 2025 reveals a new normal characterized by constant flux. January brought a month of lacal and phantom shifts establishing a baseline of continuous minor fluctuations. March 13-27 delivered a March Core Update focused on surfacing more content from creators. The implementation suggested partial attempts at addressing previous over-corrections affecting independent publishers.

June 30-July 17 brought the June Core Update characterized by past reports of partial recoveries for sites previously hit by the 2023 Helpful Content Update. This represented the first meaningful recovery window for HCU victims after nearly two years of traffic suppression. August 26-September 22 introduced the 27-Day Spam Update featuring unusually long, widespread implementation.

Analysis suggested technical changes breaking traditional tracking tools used by SEO professionals. November saw a “Movember” update that arrived unconfirmed despite Zemith traffic analysis showing significant drops. November 20 brought a Gemini 3 launch with all things AI and intent rebalancing as Google integrated its latest language model capabilities into search ranking systems.

The Thanksgiving period featured unconfirmed updates with highly impactful holiday volatility affecting publishers during traditionally high-traffic periods. December 11 marked an ongoing December Core Update representing intense impact with massive seasonal swings. Publishers reported traffic drops between 40-85% during the peak holiday shopping period when advertising rates typically reach annual highs.

The five-year progression demonstrates clear trends. Confirmed update frequency declined from 10 annual announcements in 2021-2022 to approximately 4 in 2025. Simultaneously, unannounced algorithmic changes increased substantially. Tracking tools detected major ranking movements occurring without corresponding Google confirmations or explanations.

Implementation duration expanded from typical 14-day windows to extended rollouts exceeding 45 days in extreme cases. The March 2024 core update required 45 days for full deployment, creating unprecedented uncertainty for site owners attempting to measure impact during extended volatile periods.

Google’s communication approach shifted from proactive announcements toward reactive acknowledgment only when community pressure demanded clarification. The company began emphasizing that continuous smaller updates occur constantly between major confirmed deployments. This messaging change validated long-standing suspicions within the SEO community regarding unannounced ranking adjustments.

Recovery patterns from negative impacts became increasingly difficult. Sites affected by the September 2023 Helpful Content Update experienced nearly two years of suppressed visibility before partial recoveries began appearing during mid-2025 updates. Even then, full restoration remained rare with most affected publishers achieving only fractional improvements.

Your go-to source for digital marketing news.

No spam. Unsubscribe anytime.

The shift toward AI-generated overviews and enhanced SERP features compounded traditional ranking volatility. Publishers maintaining top positions reported declining traffic despite stable rankings as Google provided direct answers within search results. This pattern contributed to numerous publisher closures throughout 2024-2025.

Traffic distribution across Google surfaces transformed dramatically during the documentation period. Web Search declined from 51% to 27% of news publisher traffic between 2023-2025 while Google Discover climbed to 68%. This redistribution created additional volatility as publishers navigating ranking fluctuations simultaneously faced structural changes in how audiences discovered content.

The algorithmic evolution affected different content categories with varying intensity. Your Money Your Life content including health, medical, finance, and legal websites demonstrated particularly high volatility during core updates. E-commerce and affiliate marketing sites experienced severe impacts during product review updates and helpful content implementations.

Independent publishers faced disproportionate challenges compared to major platforms. Data showed Reddit, Wikipedia, YouTube, and LinkedIn dominated AI search citations while smaller publishers struggled for visibility. User-generated content platforms received preferential treatment in large language model results, creating asymmetric competitive dynamics.

Multiple prominent publishers closed operations or drastically reduced staff following sustained algorithm impacts. GGRecon shut down in October 2024 after experiencing irrecoverable traffic losses from the September 2023 Helpful Content Update. The UK gaming publisher had achieved record visitor numbers in August 2023 before the algorithmic change eliminated their search visibility.

Geekflare reduced its workforce from 53 employees to 2 people following a 90% traffic decline. The technology publisher founded in 2015 had reached 6 million monthly pageviews before algorithm changes destroyed its business model. Spanish automotive website Test Coches lost approximately 3 million monthly readers following Helpful Content Update implementation.

The documentation period saw Google acknowledge search quality challenges for the first time. The company’s public statements admitted some updates had affected sites producing genuinely helpful content alongside those employing manipulative tactics. This admission represented a significant departure from previous positions that algorithmic changes reliably identified quality content.

Industry advocates argued Google’s dependency on publisher content should translate into greater publisher input regarding algorithm modifications. Critics highlighted that independent publishers built the web content Google indexes while bearing disproportionate risk from ranking volatility. These tensions intensified as algorithm changes increasingly concentrated visibility among major platforms rather than independent publishers.

Technical SEO practices that generated strong results between 2018 and 2022 became actively harmful by 2024-2025. Tactics including aggressive content scaling, programmatic SEO, and purchased backlink strategies triggered detection systems that previously rewarded such approaches. Sites experienced penalties for optimization work that succeeded just years earlier.

The integration of SpamBrain AI deployment beginning in late 2022 represented a fundamental shift in detection capabilities. Machine learning systems identified patterns across millions of sites simultaneously rather than relying on manual review or rule-based detection. This enabled Google to target sophisticated manipulation schemes that previously evaded detection through complexity or scale.

The data reveals Google simultaneously reduced official update confirmations while increasing actual ranking changes. The company shifted from monthly or quarterly major announcements toward continuous minor adjustments punctuated by occasional large-scale deployments. This approach created persistent uncertainty for site owners attempting to diagnose traffic changes or plan optimization strategies.

Multiple tracking platforms including Semrush, Advanced Web Rankings, Mozcast, Sistrix, Cognitive SEO, SimilarWeb, Accuranker, Mangools, Wincher, Data For SEO, SERPstat, and Algoroo detected coordinated volatility spikes throughout the documentation period. These tools measure daily ranking changes across millions of keywords to identify when Google implements significant adjustments.

The tools showed synchronized increases during confirmed updates validating their detection accuracy. However, they also registered substantial volatility during periods lacking official Google acknowledgment. This gap between detected changes and official communications became a defining characteristic of the 2024-2025 environment.

Recovery timelines extended significantly for sites experiencing negative impacts. Google’s guidance suggested meaningful ranking improvements often required subsequent core update cycles rather than immediate content modifications. Site owners facing traffic losses potentially waited months between opportunities for algorithmic reassessment.

Follow PPC Land on your socials: LinkedIn, Google, Google News, X, Mastodon, Bluesky, Reddit, Threads or via RSS

The June 2025 core update demonstrated some recovery patterns for sites previously affected by the September 2023 Helpful Content Update. Industry analysts documented partial visibility improvements among HCU victims after nearly two years of suppression. However, many publishers experienced mixed results with some achieving fractional gains while others saw additional declines.

HouseFresh achieved notable recovery surpassing pre-update visibility levels, but representatives emphasized this represented an exceptional case. The scarcity of full recovery examples suggested algorithmic assessments remained sticky once applied, with systems reluctant to reverse previous negative evaluations.

The transformation documented by Ghotra reflects broader strategic shifts within Google’s approach to search quality and commercial viability. The company increasingly positioned itself as an AI agent providing direct answers rather than a directory connecting users to external websites. This philosophical evolution created fundamental tensions with publishers depending on search referral traffic for sustainability.

The December 2025 core update arriving during peak holiday shopping exemplified the volatility’s impact on publisher revenue. Sites experienced traffic drops between 40-85% during their most profitable period when advertising rates reach annual highs. The timing proved particularly harsh for content publishers facing simultaneous traffic collapse and missed monetization opportunities.

The five-year analysis demonstrates Google’s search ecosystem evolved from predictable episodic updates toward continuous algorithmic flux. Site owners operating in this environment face persistent ranking volatility rather than extended stability periods between major adjustments. This dynamic rewards adaptive optimization strategies over static approaches while creating substantial business uncertainty for publishers dependent on search traffic.

Subscribe PPC Land newsletter ✉️ for similar stories like this one

2021:

2022:

2023:

2024:

2025:

Subscribe PPC Land newsletter ✉️ for similar stories like this one

Who: SEO consultant Gagan Ghotra documented five years of Google search ranking volatility affecting website owners, digital publishers, SEO professionals, and marketing organizations globally. Independent publishers including GGRecon, Geekflare, Test Coches, and HouseFresh experienced dramatic traffic changes ranging from complete business closures to rare recovery cases.

What: The analysis reveals Google’s search ecosystem transformed from predictable episodic algorithm updates to continuous high-intensity ranking fluctuations between 2021 and 2025. Confirmed updates decreased from 10 annually in 2021-2022 to 4 in 2025 while general volatility reached record-breaking levels. Major updates included the September 2023 Helpful Content Update causing widespread publisher damage, the 45-day March 2024 Core Update representing Google’s most aggressive restructuring, and the December 2025 update triggering 40-85% traffic drops during peak holiday shopping.

When: Gagan Ghotra published the comprehensive volatility analysis on December 29, 2025, documenting the period from January 2021 through December 2025. The September 14-28, 2023 Helpful Content Update became a watershed moment affecting thousands of publishers. The March 5-April 19, 2024 deployment marked the longest single update at 45 days. The December 11-29, 2025 core update represented the third confirmed algorithmic modification of 2025.

Where: The algorithmic changes affected Google Search results globally across all industries, geographic regions, and content categories. Impact extended across multiple Google surfaces including web search, image search, video search, Google News, Google Discover, and AI Overviews. Traffic distribution shifted dramatically with web search declining from 51% to 27% of news publisher traffic while Google Discover climbed to 68% between 2023-2025.

Why: Google implemented the changes to refine content evaluation systems, combat spam and manipulation, integrate AI capabilities including Gemini language models, and shift from traditional search directory toward AI agent providing direct answers. The company emphasized continuous algorithmic improvements targeting content created for search engines rather than users. The transformation created business uncertainty for publishers dependent on search traffic while concentrating visibility among major platforms including Reddit, Wikipedia, YouTube, and LinkedIn over independent publishers.

AI Search